Smarter Crypto Portfolios for Everyday Investors

Build a Clear, Confident Path to Long-Term Crypto Growth

We create customized crypto portfolios based on your goals and risk level. With clear strategies, expert support, and ongoing updates, you’ll always know where you stand and what to expect.

THAT'S HOW IT'S DONE

Results That Speak for Themselves

Behind every result is a disciplined strategy — designed for real people, built for long-term success, and driven by clear thinking, not hype.

$50K+

Assets Under Management

We actively manage over $50,000 in crypto assets across diverse portfolios — a strong and growing indicator of investor trust.

50+

Active Client Accounts

More than 50 investors rely on us to build, manage, and monitor their portfolios with clarity and confidence.

25%

Average Annual Return

Our portfolios are designed for sustainable growth — delivering an average 25% annual return across risk tiers.

24/7

Market Monitoring Coverage

We keep watch around the clock, so your portfolio is always protected and optimized — even while you sleep.

Smarter Crypto Portfolios for Everyday Investors

Results That Speak for Themselves

Every number reflects real portfolios, built with care and backed by smart strategies.

Our focus is simple:

$50K+

Assets Under Management

50+

Active Client Accounts

25%

Average Annual Return

24/7

Market Monitoring Coverage

Strategy Options

Explore Our Portfolio Frameworks

Each portfolio is designed around a different level of risk and return — giving you a clear view of how we build strategies that align with real investor goals. From stable growth to high-upside opportunities, there’s a structure that fits.

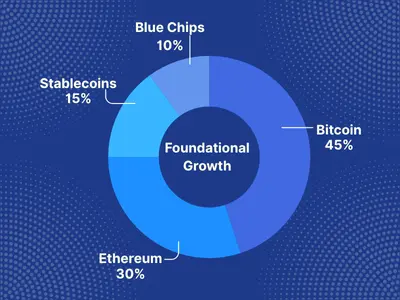

Foundational Growth

A steady-growth strategy focused on Bitcoin, Ethereum, and stablecoins. Ideal for long-term investors seeking low-volatility exposure.

Target: 15-25%

Risk: Low-Medium

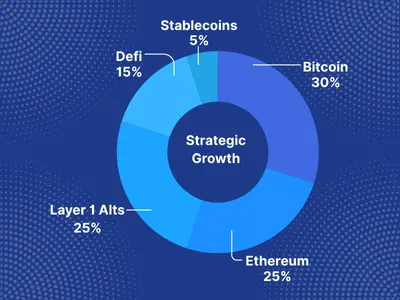

Strategic Growth

A balanced portfolio combining large-cap and mid-cap assets. Built for investors aiming for solid returns without taking on excessive risk.

Target: 25-45%

Risk: Medium

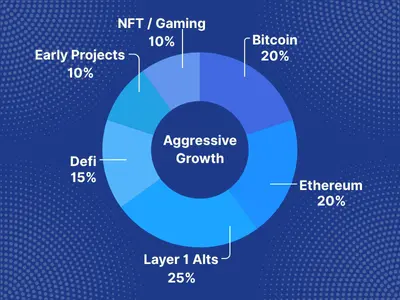

Aggressive Growth

High-upside exposure to emerging sectors like NFTs, gaming, and early-stage tokens. Best suited for experienced investors comfortable with risk.

Target: 40-80%

Risk: High

Custom Enterprise Strategy

We offer fully personalized portfolio for high-net-worth clients and institutions. Built around your goals and risk profile, with direct founder access and ongoing expert management.

HOW IT WORKS?

Building Your Portfolio, Step by Step

We make crypto investing simple and transparent. From understanding your goals to managing your portfolio, we guide you through every step with expertise and clarity.

Discovery

We start by learning your financial goals, timeline, and risk tolerance to tailor the right strategy.

Strategy Design

Using market insights, we create a custom portfolio aligned with your profile and objectives.

Asset Allocation

We carefully distribute your capital across sectors and assets to optimize growth and manage risk.

Ongoing Guidance

We monitor your portfolio, provide regular updates, and adjust allocations as the market evolves.

Why Investors Trust Us

A Smarter Way to Build Your Crypto Portfolio

We combine data-driven strategy with human insight to help you grow with confidence. Our portfolios are transparent, disciplined, and aligned to your financial goals — backed by expert support and performance you can track.

Portfolio Tiers for Every Investor

Investment Plans Built Around You

Whether you're just getting started or optimizing an existing portfolio, our plans are structured by risk level to align with your financial goals. Each tier is diversified, monitored, and built to perform over time.

Starter

Monthly Returns 5–10%

Max monthly drawdown ~7%

Portfolio $300–$1,000 • 50% of monthly net profits

GROWTH

Monthly Returns 10–15%

Max monthly drawdown ~5%

Portfolio $1,000–$10,000 • 50% of monthly net profits

Premium

Monthly Returns 15–25%

Max monthly drawdown ~5%

Portfolio $10,000–$100,000 • 50% of monthly net profits

Custom Enterprise Solutions

For institutional investors and high-net-worth individuals with portfolios exceeding $100,000, we offer bespoke services tailored to your specific requirements

Disclaimer: Performance is illustrative and does not guarantee future results. Always invest responsibly.

usama sagheer - founder & Portfolio Architect

One Vision. One Builder. One Portfolio at a Time.

I built this to give people a smarter, more thoughtful way to invest in crypto. Every portfolio is designed and managed by me. No shortcuts, no outsourcing. Just disciplined strategies, built with care and full responsibility.

"Every portfolio I build is a reflection of care, discipline, and long-term belief."

USAMA SAGHEER

Founder & Portfolio Architect

Ready to Take the Next Step?

Let’s Talk About Your Portfolio.

Whether you have questions, need guidance, or are ready to start, our team is here to help. Reach out and we’ll get back to you with clear answers and next steps.